The 40-Day Sweet Spot: Rethinking Your Stock Holding Period

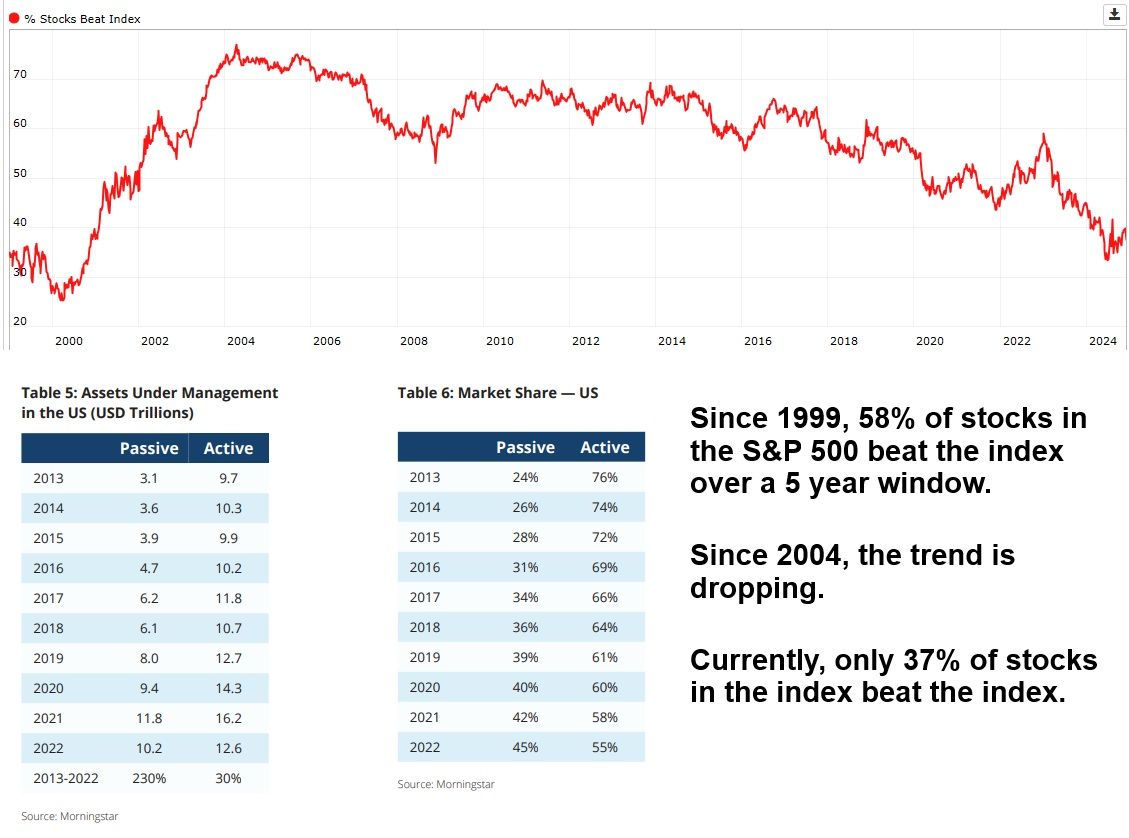

Most S&P500 constituents fail to outperform the Index in the long run. The evidence provided by Kurtis Hemmerling in his LinkedIn post is compelling and highlights this challenge for individual stock pickers.

So, if you buy stocks for the long haul, the odds are greatly stacked against you. Buy and hold does not work. Neither for the Indexes, much less for individual stocks.

So, if you buy stocks for the long haul, the odds are greatly stacked against you. Buy and hold does not work. Neither for the Indexes, much less for individual stocks.

What to do to have a decent change of being a winner in the stock market?

1) Buy-and-hold investing in a portfolio of stocks is a recipe for underperformance. One cannot fall in love with a specific stock. The investor needs clear rules for when to buy and sell. The specific criteria for effective buying and selling will be addressed in a future discussion.

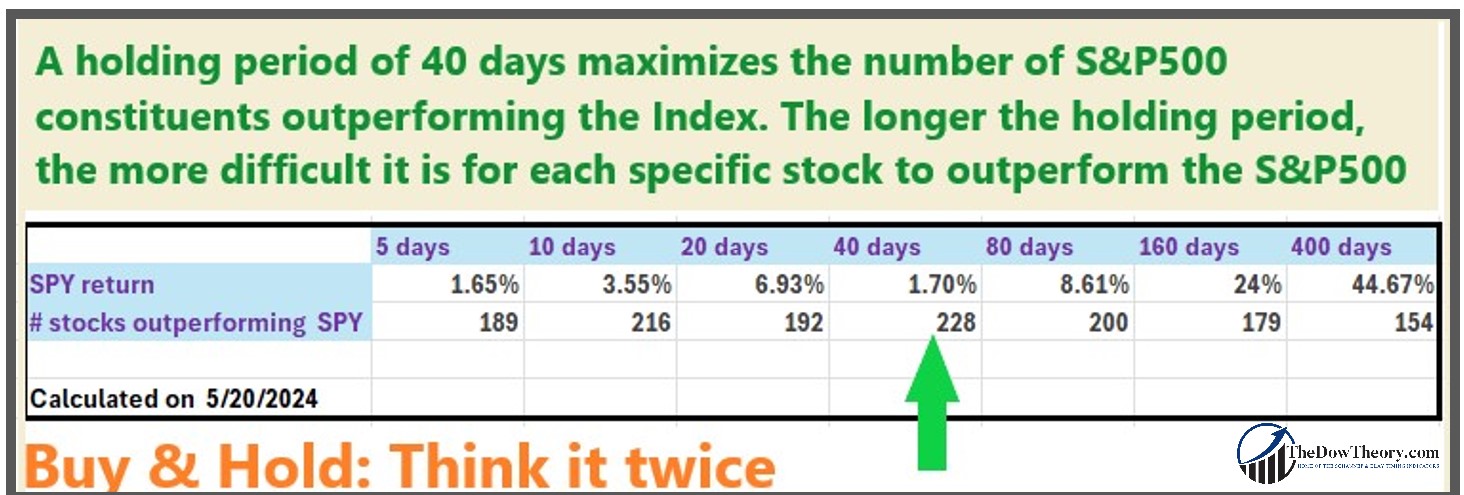

2) Shorten your holding period. Over shorter timeframes, such as a quarter, more stocks have the potential to outperform the S&P 500, even though eventually they will fizzle out. The table below, which I produced some months ago, shows that the “sweet” point for holding stocks is 40 days, as this holding period results in most stocks outperforming the index.

3) And last but not least, employ a reliable trend-following indicator. All stocks tend to decline during bear markets regardless of their individual merits. Our Composite Indicator does a great job in identifying market turns.

Interestingly, stocks are better timed by focusing on the overall market trend rather than their individual trends. This is because the signal-to-noise ratio of individual stocks is higher and more prone to false signals, while the market as a whole provides a more reliable indicator of its own trend and that of its constituent stocks (source: “Stock Market Cash Trigger“, David Alan Carter).

Does it entail more work? Yes, but the reward is less drawdowns and more outperformance. There are no shortcuts in the stock market, and success requires diligence and a well-thought-out strategy.

Sincerely,

Manuel Blay

Editor of thedowtheory.com